Are You Eligible for PMAY Scheme? Find Out Now

PMAY scheme was launched in 2015 to empower people from EWS, LIG, and MIG to buy a house of their own. But to benefit from the scheme, one needs to meet its eligibility criteria. Check out whether you are eligible for the scheme in this post.

While India has developed significantly in the last decade, a large number of people still do not have a home to call their own. Launched in June 2015, the PMAY scheme is one of the biggest steps by the government towards its “Housing for All by 2022” mission. The scheme empowers people from EWS, Low Income and Middle Income Group to purchase their dream house.

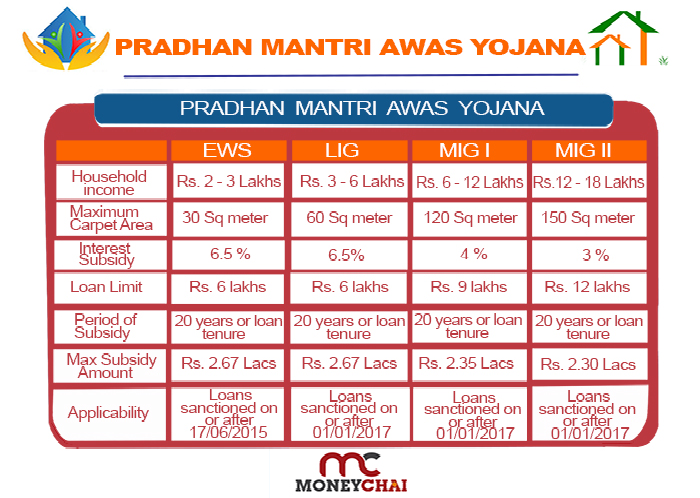

CLSS or Credit-Linked Subsidy Scheme is one of the most important initiatives under PMAY. Under this scheme, the government offers financial assistance to people from EWS, LIG, and MIG to help them purchase a home. But to benefit from the scheme, one needs to meet the eligibility criteria of the scheme.

Here is the detailed information on the eligibility requirements of the PMAY scheme-

Eligibility Requirements of PMAY for EWS/LIG

If your household income is up to Rs. 6 lakhs in a year, you fall under the EWS/LIG category. To be eligible for the loan subsidy under the PMAY scheme, a person from EWS/LIG should-

- Not own a pucca house in their name in any part of the country

- Household or family too should not own a pucca house in their name throughout the country

- Not have availed any kind of state or central assistance under any other housing scheme of the government

- Have a female member of the family as a co-owner of the house

- Ensure that the location where the property is located is eligible for the scheme

Eligibility Requirements of PMAY for MIG I and MIG II

You belong to MIG I if your household income is between Rs. 6 lakhs and Rs. 12 lakhs in a year. If the household income is between Rs. 12 lakhs to Rs. 18 lakhs, you are under MIG II. The eligibility requirements for people from MIG I and MIG II are similar to the requirements for EWS/LIG.

The only significant difference between the two is the fact that while female co-ownership is compulsory for EWS/LIG, it is only desirable for MIG I and MIG II.

Benefits of CLSS

With the help of CLSS, people from EWS/LIG can get a maximum loan subsidy of up to Rs. 2.67 lakhs while people from MIG can save up to Rs. 2.35 lakhs on their home loan interest. If you apply for loan subsidy and your application is approved, the subsidy amount would be credited to your loan account upfront to reduce the effective EMI and home loan.

To apply for a home loan under PM Awas Yojana, you should get in touch with a lender that is approved for this scheme.

Some Final Thoughts

So, if this is the first time that you’re buying a home and belong to the EWS/LIG or MIG, you can save a considerable amount of money under PMAY.

Before applying, make sure that you thoroughly understand the eligibility requirements of the scheme to avoid any discrepancy. Contact an approved lender to know more about the scheme and get answers to all your queries.